China’s Evergrande Group

American investors awoke to turmoil Monday morning from news that one of China's largest real estate lenders, Evergrande Group, missed interest payments for two of its largest lenders. The Chinese real estate sector accounts for nearly 10% of its overall GDP, so the issue has severe implications for the world's second-largest economy. Currently, the lending giant owes over 1.9 trillion yuan ($300 billion) to banks and bondholders. While famous US financial institutions only have fractional exposure to the firm, the overwhelming majority of Chinese banks have a stake in Evergrande.

There was no escaping the sell-off as an American investor. With the Dow Jones declining each of the last three weeks and uncertainty surrounding the Covid-19 Delta variant, the markets were due for any type of correction. By 4 pm EST Monday, the S&P 500, Dow, and Nasdaq averaged a 1.89% drop. Moreover, cryptocurrencies took a hit after exchange-traded funds faltered across the board. The Grayscale Bitcoin Trust (GBTC) ETF saw an 8.32% pullback over the trading day, causing a significant sell-off of bitcoin from its balance sheet. Ultimately, Bitcoin and Ethereum fell 7.69% and 10.50%, respectively.

Indexes struggled to rebound Tuesday but are performing exceptionally well heading into market close on Wednesday. This turn is propelled by a recent exchange filing by Evergrande's Hengda Real Estate Group, stating it will be able to make the coupon payment for both its municipal bond and offshore dollar bond due Thursday. Though these interest payments come as a hopeful surprise to many, Evergrande is far from out of the water.

The State of Chinese Real Estate - “THREE RED LINES”

Evergrande's potential collapse is no surprise to the active investor. Rumors have been circling about the company since a letter requesting government assistance with liquidity issues was posted online a year ago. Evergrande is China’s second-largest real estate developer with 1.4 trillion yuan ($220 billion) in assets consisting primarily of land and housing projects. Evergrande’s struggles posed a major threat for China, but it wasn’t alone. Last year, close to 500 Chinese real estate companies went bankrupt. The issue forced the Government of China to impose the "three-red line" policy in 2021. The three lines aim to prevent a potential bubble in an inflating Chinese real estate market. In order to protect investors and home buyers, developers must maintain a:

Loan to Value ratio of less than 70% (Prevents companies from holding more than 70% of total assets as outstanding debt)

Net Debt ratio of less than 100% (Total debt may not exceed shareholders equity)

Cash ratio of more than 1x (Cash and marketable securities must be available to pay off debt)

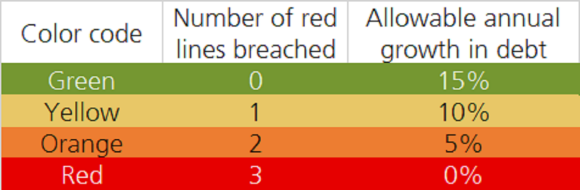

Companies earn green, yellow, orange, and red ratings based on the number of lines breached. As a result, debt growth limits of 15%, 10%, 5%, and 0% are placed on developers corresponding to the color received. While nearly half of China's developers were able to comply with criteria by the end of last year, Evergrande could never lift itself from a red rating.

What's Next? The Future Outlook:

There is a lot to pay attention to as we close out September—Historically, the market's worst-performing month. In Washington, Congress faces a September 30 deadline to pass a bill suspending the $28.4 trillion US debt ceiling until late 2022. The ceiling has already been breached and funded with the Treasury Department’s “extraordinary measures," which will be running out next month. Increasing the debt limit does not allow for additional spending but instead the ability to finance Social Security, Medicare, military, and tax refund obligations. The bill, to be voted on this week, will fund the government until January and prevent the US from defaulting on debt due in October. A default would cause a global economic downturn. Interest rates would jump, bonds would suffer, and stocks would take a hit. Additionally, any country doing business in USD would take a pay cut as all roads lead back to the ten-year treasury yield and the US credit rating.

Suspending and raising the debt ceiling has always been center stage in contemporary US political theater. Neither Democrats nor Republicans want to look responsible for the suspension because it appears they are approving future spending to the public eye. This time around, Pelosi doesn't want the optics of endorsing payments that we’re in fact made by President Trump. So, we're left in a stalemate with consumer confidence held in escrow. The Democratic-controlled House approved the debt limit bill Tuesday that will likely be dead on arrival in the Senate, where it would need 60 votes. Democrats could use the process of reconciliation to pass the debt ceiling suspension with their Senate majority but are looking for bipartisan support to preserve their chances in the future midterm election. With no apparent solution on the horizon, the Federal Reserve is our next topic of focus.

After the Federal Open Market Committee (FOMC) today, the Federal Reserve indicated that it could begin reversing stimulus programs by November and start raising interest rates early next year. According to the Wall Street Journal, the Fed’s rate-setting committee modified its post-meeting statement today, stating that it could also start reducing, or tapering, its $120 billion in monthly asset purchases as soon as the next scheduled meeting. In the coming weeks, investors should hear more details regarding the impact of the Fed's bond-buying and whether it will hold off on tapering those purchases until the economy is on more stable ground. If you're interested in quantitative easing programs, keep an eye out for other central bank decisions from Brazil, UK, Japan, and Switzerland this week.

Of course, the main answers lie across the Pacific. The Government of China faces a decision regarding Evergrande's liquidity and potential insolvency problem. To preface, the government has all the tools necessary to handle this fiasco. American media is quick to jump to "Lehman Brothers moment" headlines, but investors shouldn't buy into that narrative. Though the company has its hands in everything from healthcare to finance, the difference is that Evergrande is only a real estate developer at its core.

In the wake of default, the government will most likely restructure Evergrande to ensure that average real estate buyers who paid upfront for housing don't bear the burden. These are undoubtedly turbulent times in a Chinese economy that have seen an 8.3% decline in GDP growth since 2010, according to The World Bank. As China emerges from this summer, investors need to question what the Chinese economy will look like in the near future. The answers may not be too far away, as politicians Beijing and DC seem to have little in common. Last year, Luckin' Coffee, a Chinese beverage-delivery company listed on the Nasdaq, was caught inflating its sales, resulting in even greater political distress in the US. As a result, the Holding Foreign Companies Accountable Act was signed into law, requiring companies traded on American exchanges to submit to audits or face de-listing within three years. Soon, Beijing will likely begin to govern with a stronger hand to prevent another default of this magnitude. Again, investors should proceed with caution when handling Chinese investments and consider the implications of its governmental policies. A potential pivot lies ahead to reign in the capitalist model in China, shifting power to the hands of a government that does not have the best interest of global investors in mind. Let's take a proactive, diligent approach moving forward.